How to get Kaiser to pay for out-of-network?

Wondering how to get Kaiser to pay for out-of-network? Then you have reached the right place. This article is your guide to understanding the nitty-gritty and how you can go about it.

Let’s delve into the basics first.

What is Kaiser?

Kaiser Permanente is a renowned United States healthcare provider serving eight states and the District of Columbia. Its mission is to offer quality, accessible, and cost-effective healthcare services through a collaboration of physicians, specialists, and caregivers.

What are out-of-network services?

Out-of-network services are the services that a policyholder gets from a non-participating provider. Kaiser does not pay if you attain the covered services without prior authorization or get out-of-network services. However, there are chances of getting these services covered by the insurer, but only if you are in an emergency or get them approved in advance.

Under which circumstances does Kaiser offer reimbursement for out-of-network services?

Kaiser offers reimbursement for out-of-network services under these three circumstances:

1. Out-of-state urgency while traveling

If you happen to travel and a medical urgency makes you pay from your pocket during the travel, the policyholder can file for reimbursement after the trip. If you are traveling outside the United States, do not forget to keep proof of travel with you. It can include airline tickets or a copy of the itinerary.

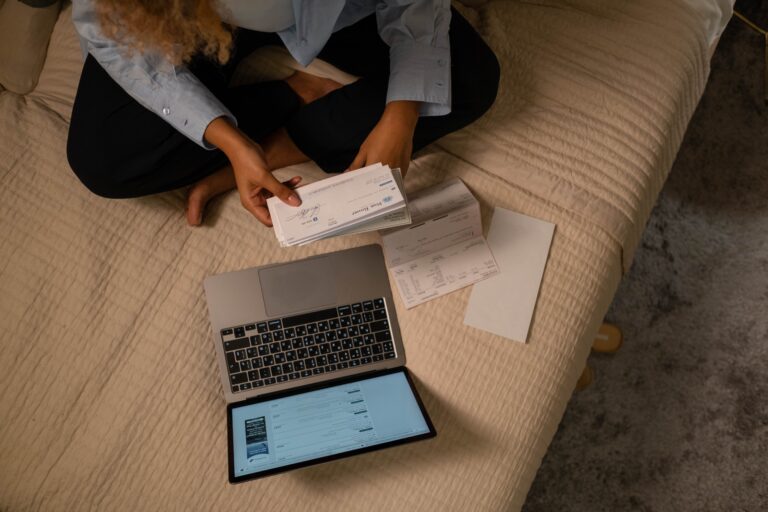

List of required documents for all the claims:

- Itemized bills

- Receipts and bills

- Medical records

2. Medical Emergency

Keep in mind after receiving the out-of-network services from a non-participating provider, you will be required to submit a claim, an itemized statement, clearing stating the services you have asked for. Kaiser reviews and authorizes the claims only after the services have been achieved. Kaiser can only confirm the membership status if the policyholder or a family contacts the insurer during the emergency; action will be taken only after receiving the services, as stated earlier.

After Kaiser receives the claim and other relevant information regarding out-of-network services, their team will determine if the services fall under Kaiser Permanente Plan. Kaiser clearly states that filing a claim itself doesn’t guarantee reimbursement. However, if the team approves the claim, the service provider will be paid as per the policyholder’s health insurance plan.

If the policyholder had paid for out-of-network services from his pocket, they could file a claim on their claim. They must submit receipts, documentation, proofs, and a written statement within 90 days of receiving the services.

3. Written referral by a Kaiser Permanente physician that Kaiser Permanente authorizes

Kaiser can also approve of out of network medical services if they fail to provide reasonable access to medical care for a certain condition or disease. In such cases, you will be required to have an approved referral to out-of-network so that Kaiser can provide reimbursement for the provided medical services. Once the referral gets approved, you will have to pay only what you would have to pay for covered medical care.

Conclusion

Kaiser has been serving its patients with the best healthcare services for years and continues to lead the market. We hope this article helped our readers understand Kaiser’s out-of-network policies. Stay connected with us for more such informational content.

Also, Read: How much does insurance pay for ABA Therapy?