Why Doesn’t Dental Insurance Cover Anything? Exploring Coverage Limits

Dental care is an essential aspect of overall health, yet the importance of dental insurance is often overlooked. Many view dental insurance negatively, primarily because it falls short of covering necessary treatments, thus becoming more of a financial burden than a support system.

Understanding Dental Insurance Coverage

Dental insurance is designed to offer financial support for both restorative and preventive dental care. However, it frequently does not cover essential treatments such as cleanings, regular check-ups, fillings, and tooth extractions. The situation worsens with complex dental diseases, where insurance fails to provide adequate financial coverage.

Why does Dental Insurance cover so little? Key Limitations of Dental Insurance

Dental insurance typically offers more limited coverage compared to medical insurance due to the predictable nature of dental care needs. Here’s a clearer breakdown of why dental insurance often covers so little:

1. Restricted Coverage for Major Treatments:

Dental insurance often excludes significant procedures like dental implants, root canals, orthodontic work, and crown bridges. Consequently, individuals may need to purchase additional insurance for comprehensive coverage, leading to increased financial strain.

2. Waiting Periods:

Many dental insurance policies include waiting periods and limiting coverage for certain treatments. This can be particularly challenging for pre-existing conditions, as treatments required within a specified timeframe may not be covered, leaving gaps in necessary care.

3. Limited Annual Coverage:

Dental insurance typically caps the amount it will pay out annually. Once you reach your annual maximum, any additional costs are your responsibility. This limitation can make dental care unaffordable for many.

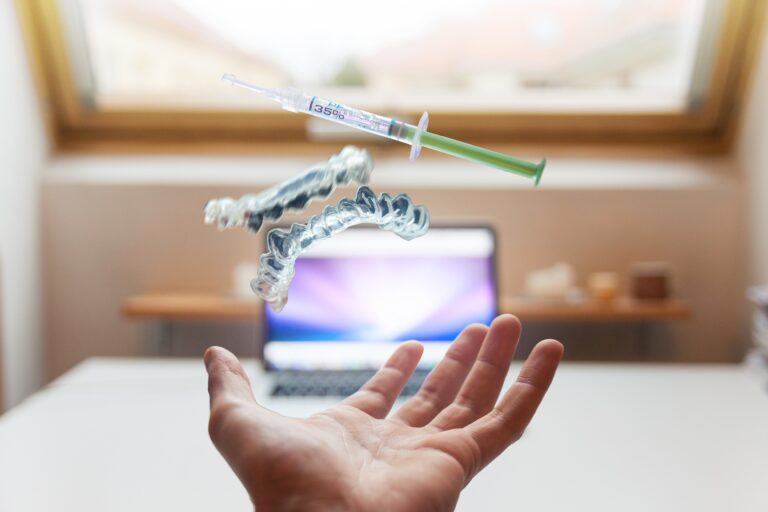

4. Exclusion of Cosmetic Treatments:

Treatments aimed at improving dental appearance, such as teeth whitening and veneers, are not covered. This exclusion extends to treatments that many consider essential for a healthy smile.

5. Deductibles and Co-Payments:

Many dental insurance plans include deductibles and co-payments, further adding to the out-of-pocket costs for insured individuals.

In summary, dental insurance is structured to provide financial assistance with dental care costs, focusing primarily on preventive care to maintain oral health. For more extensive procedures, coverage is less comprehensive, necessitating a clear understanding of your policy’s details to effectively plan for and manage dental care expenses.

Understanding Dental Insurance:

- Supportive Role: Think of dental insurance as a financial support system rather than a comprehensive coverage solution. It’s designed to help offset the costs of dental care, particularly for preventive services, rather than cover every expense.

- Coverage Categories:

- Preventive Care: Most plans cover 100% of preventive care, including annual cleanings, X-rays, and check-ups. This focus on preventive care helps avoid more costly treatments in the future.

- Basic Procedures: Basic care, such as fillings and simple extractions, may have higher coverage percentages but can still involve out-of-pocket costs.

- Major Procedures: For major procedures like crowns, bridges, and dentures, insurance typically covers a smaller percentage, leaving a significant portion of the cost to be paid by the patient.

- Policy Specifics: It’s crucial to understand your dental insurance policy’s specifics, including how procedures are categorized and the associated coverage levels. Policies vary in their definitions of preventive, basic, and major procedures and the corresponding coverage.

Evaluating Dental Insurance

While dental insurance aims to protect and promote oral health, it often fails to do so effectively. The restrictions, additional expenses, and limited coverage contribute to dissatisfaction and financial stress among consumers. The perception of dental procedures as cosmetic rather than necessary further diminishes the coverage scope.

Conclusion

Choosing dental insurance requires careful consideration of its limitations and financial implications. Individuals need to assess their needs and understand the coverage details before opting for dental insurance. Awareness and a critical evaluation of dental insurance policies can help mitigate some of the financial burdens and ensure better oral health care.

FAQ’s

1. What percentage does most dental insurance cover?

Most dental insurance plans follow a 100-80-50 coverage structure: 100% coverage for preventive care (exams, cleanings), 80% for basic procedures (fillings, root canals), and 50% for major procedures (crowns, bridges). However, coverage can vary based on the specific policy.

2. Why are dental problems not covered by insurance?

Dental insurance often excludes certain treatments due to their classification as cosmetic (e.g., veneers, teeth whitening) or because they are considered major procedures that exceed annual coverage limits. The perception of dental care as less medically necessary compared to other health care treatments also plays a role.

3. Is dental treatment covered by insurance?

Yes, dental treatment is covered in many health insurance policies, but the extent of coverage can vary widely. Insurance typically covers preventive care and may partially cover basic and major dental procedures, depending on the policy’s terms.

4. What is the highest annual maximum on dental insurance?

The highest annual maximum for dental insurance can vary significantly between plans and providers. Some high-end plans may offer annual maximums of $2,500 or more, but these plans come with higher premiums. Most standard plans offer annual maximums ranging from $1,000 to $1,500.

5. What happens if I can’t afford a crown?

If you can’t afford a crown and your insurance doesn’t cover the cost or you’ve reached your annual maximum, there are a few options to consider:

- Payment Plans: Some dental offices offer payment plans that allow you to pay for treatment over time.

- Dental Discount Programs: Enrolling in a dental discount program can provide discounts on various treatments, including crowns.

- Dental Schools: Receiving treatment from a dental school can be a more affordable option, as services are often provided at a lower cost.